TDS Calculator

TDS is a certain amount that is collected as a tax from the source of income. Use Our TDS Calculator to calculate the right amount of TDS.

If you use this great tool then please comment and/or like this page.

Average Rating: Tool Views: 99

Average Rating: Tool Views: 99

Subscribe for Latest Tools

How to use this TDS Calculator Tool?

How to use Yttags's TDS Calculator?

- Step 1: Select the Tool

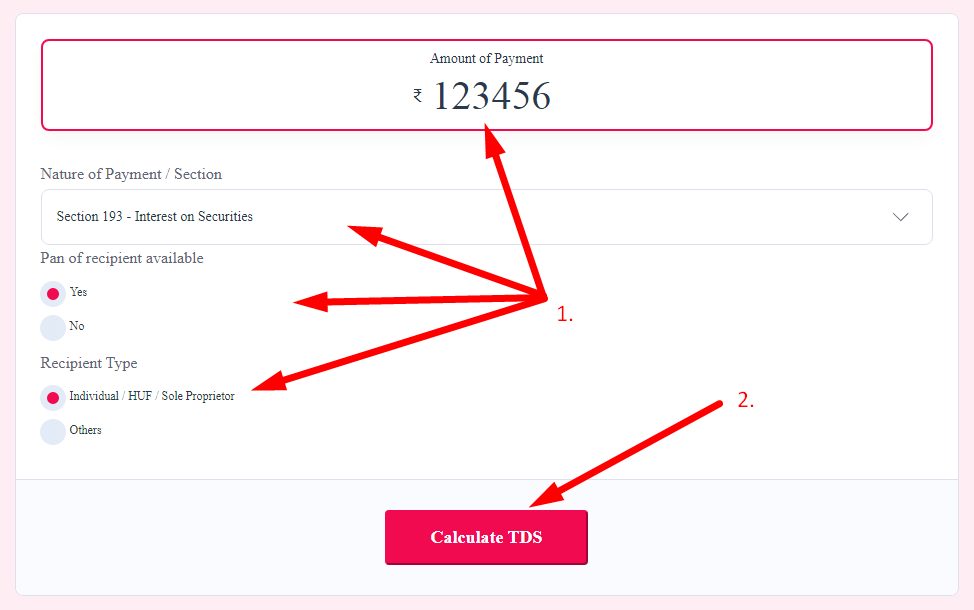

- Step 2: Enter The Following Options And Click On Calculate TDS Button

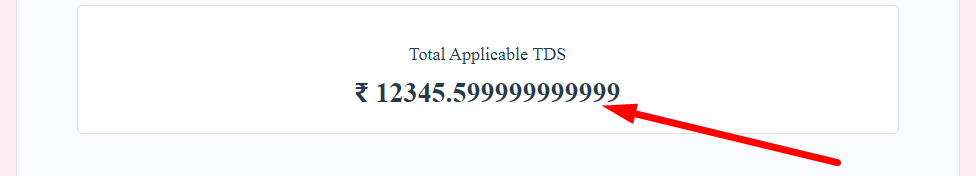

- Step 3: Check Your TDS Calculator Result

If you want to link to Tds Calculator page, please use the codes provided below!

FAQs for TDS Calculator

What is a TDS Calculator?

A TDS (Tax Deducted at Source) calculator is a tool that helps individuals and businesses in estimating the amount of tax to be deducted at source from various incomes, such as salaries, interest, or rent, in accordance with the tax regulations of a specific country.

How the TDS is calculated?

The employer deducts TDS on salary at the employee's 'average rate' of income tax. It will be computed as follows: Average Income tax rate = Income tax payable (calculated through slab rates) divided by employee's estimated income for the financial year.

How many years can TDS be claimed?

However, it is important to note that the claim for refund of excess TDS can be made only within a specified time limit, which is generally two years from the end of the financial year in which the TDS was deducted.

How do you calculate TDS average?

The formula to calculate TDS is Average Income Tax Rate = Income Tax Payable (computed with slab rates) / Estimated income for the financial year.

What happens if TDS is not deducted?

Penalty for companies for not depositing or not deducting TDS on time. The employer can make the interest payment on such late payment of TDS before filing TDS returns or demand raised by TRACES. Also, the interest paid delay while depositing TDS is not allowed as an expense under the income tax provisions.