RD Calculator

RD Calculator - Use Free Online Recurring Deposit (RD) calculator to estimate your maturity value earned on RD schemes in India.

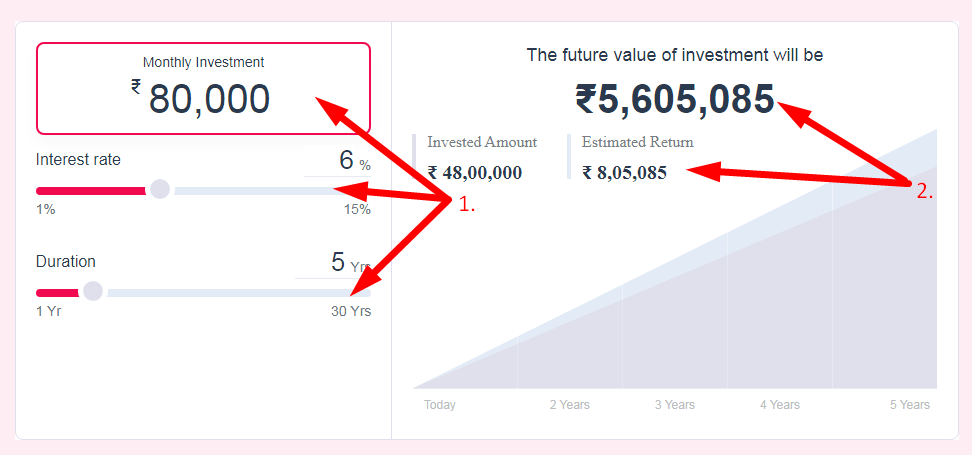

The future value of investment will be

Invested Amount

₹ 0

Estimated Return

₹ 0

If you use this great tool then please comment and/or like this page.

Average Rating: Tool Views: 177

Average Rating: Tool Views: 177

Subscribe for Latest Tools

How to use this RD Calculator Tool?

How to use Yttags's RD Calculator?

- Step 1: Select the Tool

- Step 2: Enter The Following Options And Check Your RD Calculator Result

RD Calculator - Use Our RD Calculator to estimate maturity value earned on recurring deposits schemes in India and compare the interest earned if invested in SIP. Read to know more about how is RD interest calculated & its tax benefits.

If you want to link to Rd Calculator page, please use the codes provided below!

FAQs for RD Calculator

What is a RD Calculator?

An RD (Recurring Deposit) Calculator is a financial tool that calculates the maturity amount and interest accrued on a recurring deposit account, considering factors such as monthly deposit, interest rate, and tenure.

How RD rates are calculated?

A = P(1+r/n)*n*t, where 'A' represents the overall amount obtained, 'r' represents the yearly interest rate, 'P' represents the principal, 't' represents the tenure and 'n' indicates the number of times interest has been compounded.

What are the benefits of RD calculator?

An RD deposit calculator eliminates the hassle of computing its returns manually and enables an investor to know the exact amount their deposits will accrue after the relevant period. The only consideration that the investor has to do manually is the TDS deduction.

How much is 5000 per month in RD for 5 years?

Calculation shows that a monthly contribution of Rs 5000 towards the Post Office RD scheme will result in a corpus of Rs 3.52 lakh in 5 years. If you extend the account by another 5 years, the total corpus will be Rs 8.32 lakh in 10 years.

Which is better RD or FD?

The interest amount earned at the end of maturity of a Fixed Deposit is higher than the interest earned on an RD.