FOIR Calculator

Eligibility Calculator (FOIR) How much more you can save just by switching over to Yttags!

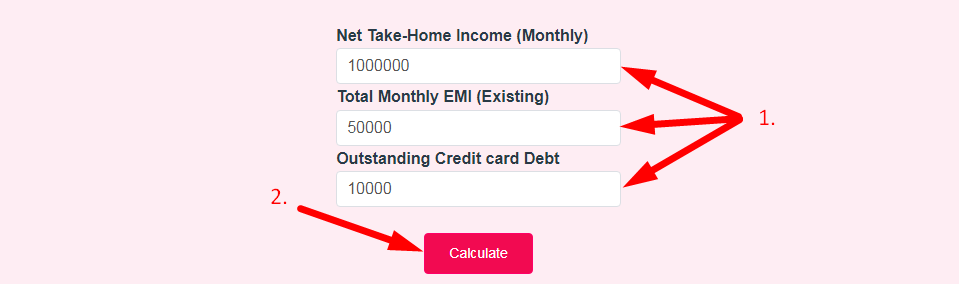

Net Take-Home Income (Monthly)

Total Monthly EMI (Existing)

Outstanding Credit card Debt

If you use this great tool then please comment and/or like this page.

Average Rating: Tool Views: 100

Average Rating: Tool Views: 100

Subscribe for Latest Tools

How to use this FOIR Calculator Tool?

How to use Yttags's FOIR Calculator?

- Step 1: Select the Tool

- Step 2: Enter The Following Options And Click On The Calculate Button

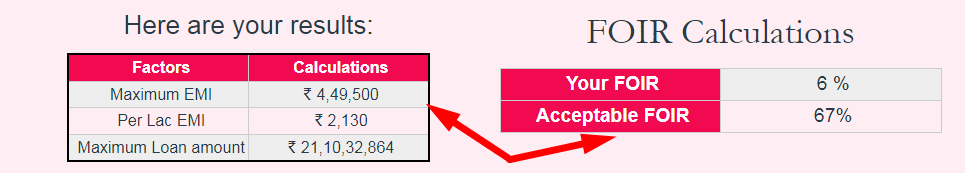

- Step 3: Check Your FOIR Calculator Result

If you want to link to Foir Calculator page, please use the codes provided below!

FAQs for FOIR Calculator

What is a FOIR Calculator?

It seems there might be a typo in your question. If you meant "FOIA Calculator," it could refer to a tool that helps estimate the cost of filing a Freedom of Information Act (FOIA) request, which allows individuals to request access to government records.

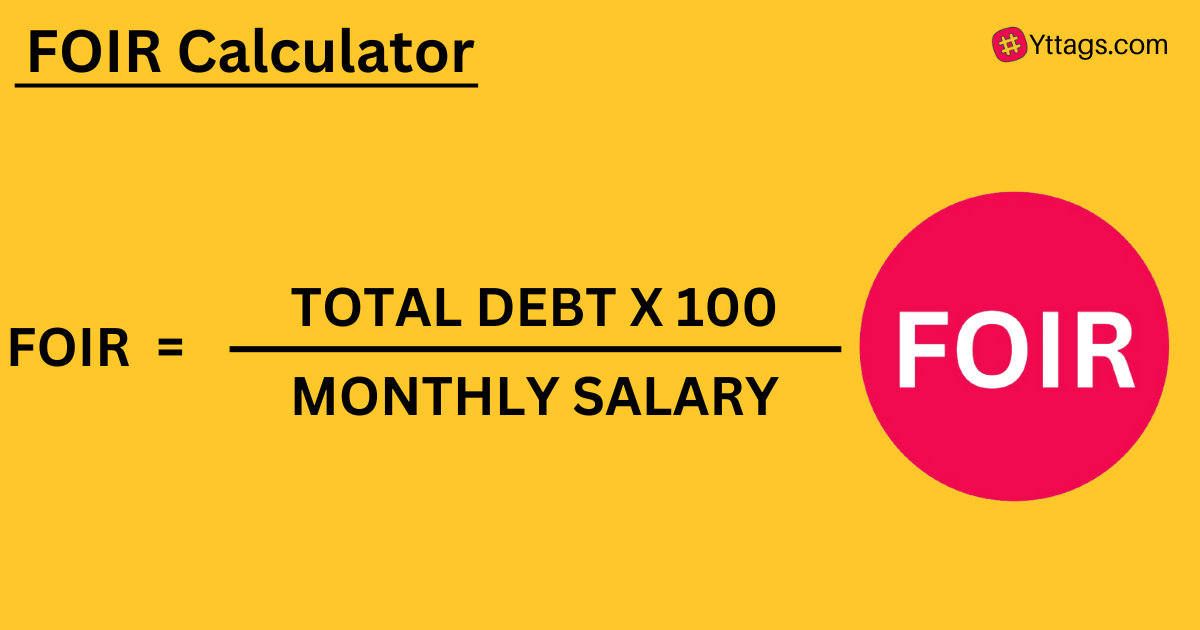

How is the foir ratio calculated?

The following is the FOIR calculation formula: = (Fixed Monthly Obligations / Monthly Income) x 100. Example: An individual makes ₹50,000 per month in income. The person may contribute up to ₹25,000 towards their debts by classifying 50% as fixed commitments.

What is the impact of foir on customers loan eligibility?

Lower FOIR means that the applicant's net monthly obligations are significantly lower than their income. This reflects a better repaying capacity of the applicant. Thus, lower the FOIR, the higher are your chances of loan approval.

How do you calculate total obligation?

The calculation of obligation amounts for all overlapping fund fiscal years is determined using the formula, OA = (CYD / OD) * ROA, Where: OA = The obligation amount for each fund fiscal year, CYD = The number of days in the obligation period that fall within the current fiscal year, OD = The number of days in the ...

How do you calculate eligible loan amount?

Your income will determine the loan amount you are eligible for. Lenders will consider your take-home salary, minus certain common deductions such as gratuity, PF, ESI, etc. The take-home salary will determine the EMI amount you can afford and thus the total loan amount you can borrow.