SIP Calculator

SIP Calculator - Systematic Investment Plan calculator is a tool that helps you determine the returns you can avail when parking your funds in such investment tools.

If you use this great tool then please comment and/or like this page.

Average Rating: Tool Views: 206

Average Rating: Tool Views: 206

Subscribe for Latest Tools

How to use this SIP Calculator Tool?

How to use Yttags's SIP Calculator?

- Step 1: Select the Tool

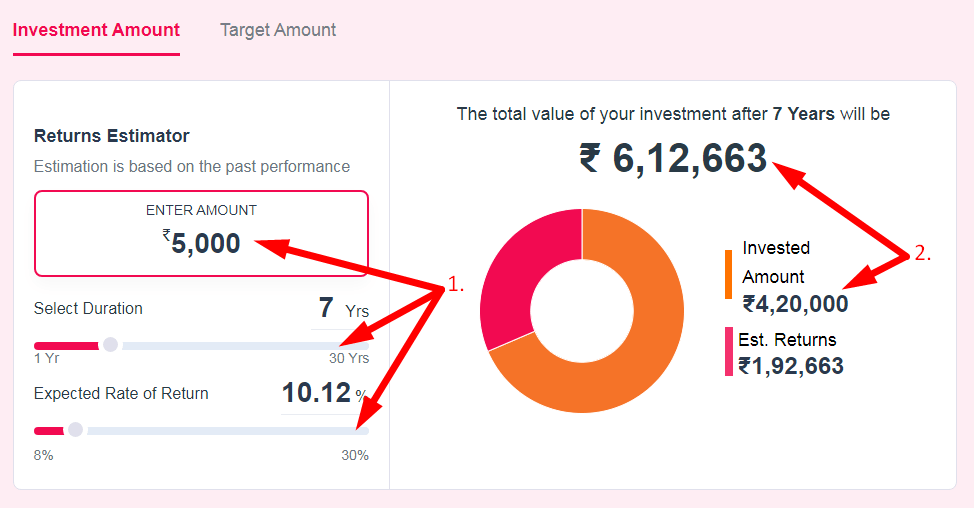

- Step 2: Enter The Following Options And Check Your SIP Calculator Result

The SIP Calculator is an easy-to-use tool to know estimated return on SIP Investment. Plan your investments with SIP Return Calculator Online.

If you want to link to Sip Calculator page, please use the codes provided below!

FAQs for SIP Calculator

What is a SIP Calculator?

A SIP (Systematic Investment Plan) calculator is a tool that helps investors estimate the potential future value of their investments made through systematic and regular contributions over time, considering factors such as the investment amount, frequency, and expected returns.

Is SIP calculator accurate?

This tool is designed to help investors understand how their investments are likely to grow over time and how much money they can expect to receive at the end of the investment period. However, it is important to note that the accuracy of SIP Calculator depends on a number of factors.

What happens if you invest 2000 per month in SIP?

Take an example where you invest Rs 2,000 per month for a tenure of 24 months. You expect a 12% annual rate of return (r). You have i = r/100/12 or 0.01. You get Rs 54,486 at maturity.

Is SIP 100% safe?

While SIPs can be a beneficial investment option for many people, it is important to note that no investment is entirely risk-free. The safety of SIPs depends on various factors, including the underlying investment instrument, market conditions, and the investor's risk tolerance.

Can SIP go in loss?

But as the market keeps falling and you continue to invest your average cost fall. You will be buying more units at a lesser cost. The primary advantage of SIP is to lower the average cost of buying mutual funds. SIPs work well in a falling market condition or volatile markets.