Depreciation Calculator

Calculate the depreciation on your assets via our powerful straight-line depreciation, and diminishing balance depreciation schedule calculators to see which method suits your process bet.

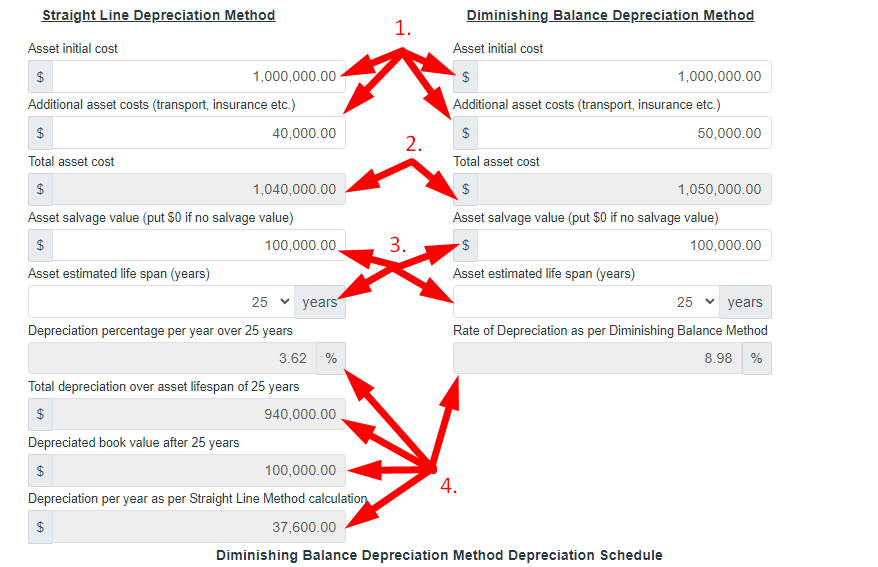

Straight Line Depreciation Method

Asset initial cost

Additional asset costs (transport, insurance etc.)

Total asset cost

Asset salvage value (put $0 if no salvage value)

Asset estimated life span (years)

Depreciation percentage per year over 15 years

Total depreciation over asset lifespan of 15 years

Depreciated book value after 15 years

Depreciation per year as per Straight Line Method calculation

$

$

$

$

years

%

$

$

$

Diminishing Balance Depreciation Method

Asset initial cost

Additional asset costs (transport, insurance etc.)

Total asset cost

Asset salvage value (put $0 if no salvage value)

Asset estimated life span (years)

Rate of Depreciation as per Diminishing Balance Method

$

$

$

$

years

%

Diminishing Balance Depreciation Method Depreciation Schedule

If you use this great tool then please comment and/or like this page.

Average Rating: Tool Views: 92

Average Rating: Tool Views: 92

Subscribe for Latest Tools

How to use this Depreciation Calculator Tool?

How to use Yttags's Depreciation Calculator?

- Step 1: Select the Tool

- Step 2: Enter The Following Value And Check Your Depreciation Calculator Result

Utilize our depreciation calculator to determine your allowable annual depreciation for your real estate investment property and find your accumulated depreciation total which will be subject to depreciation recapture tax at the sale of the property unless you utilize a 1031 exchange.

If you want to link to Depreciation Calculator page, please use the codes provided below!

FAQs for Depreciation Calculator

What is a Depreciation Calculator?

A Depreciation Calculator is a tool used to estimate the decrease in the value of an asset over time, typically for accounting and financial purposes. It helps determine the asset's book value and its remaining worth.

What four factors are necessary to calculate depreciation?

To calculate depreciation, you need four key factors: the asset's original cost, its estimated useful life, the estimated salvage value, and the chosen depreciation method.

How do you calculate depreciation easily?

To calculate depreciation easily, use the straight-line depreciation formula: (Original Cost - Salvage Value) / Useful Life.

What are the rules for depreciation?

The rules for depreciation vary by accounting standards, but common principles include choosing a depreciation method (e.g., straight-line or declining balance), estimating useful life, and considering salvage value. Depreciation expense is then recorded annually based on these factors.

Which depreciation method is best?

The best depreciation method depends on the specific circumstances and goals of an organization. Straight-line depreciation is simple and even, while methods like double declining balance may offer more significant deductions in the early years. Businesses typically choose a method that aligns with their financial objectives and tax strategies.