Compound Interest Calculator

Compound Interest Calculator Online - Use this free and easy compound interest calculator to convert and compare interest rates of different compounding periods on your savings to see however savings can grow with compound interest rates at Yttags.com.

Total Amount

Principal Amount

₹ 0

Total Interest

₹ 0

Average Rating: Tool Views: 101

How to use this Compound Interest Calculator Tool?

How to use Yttags's Compound Interest Calculator?

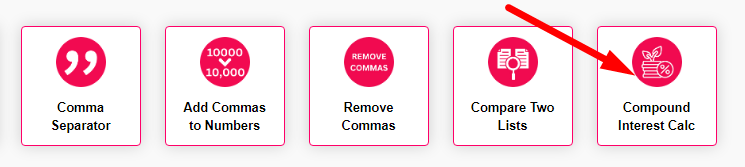

- Step 1: Select the Tool

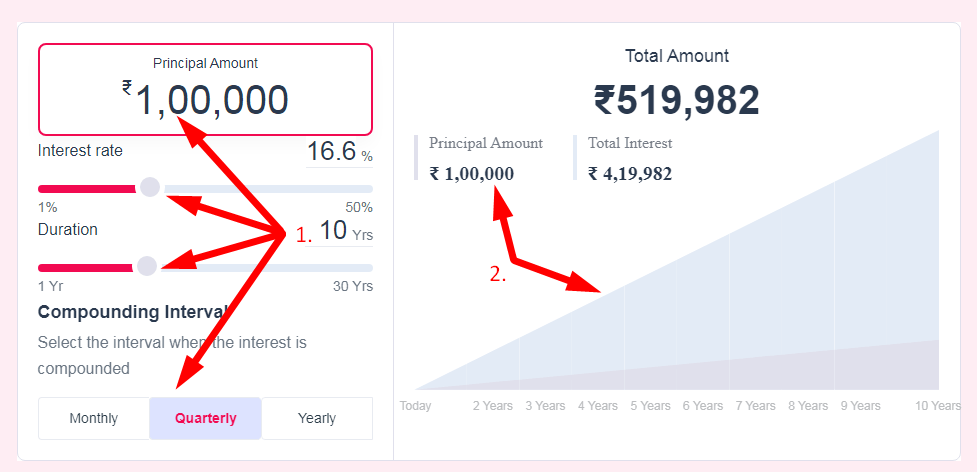

- Step 2: Enter The Following Options And Check Your Compound Interest Calculator Result

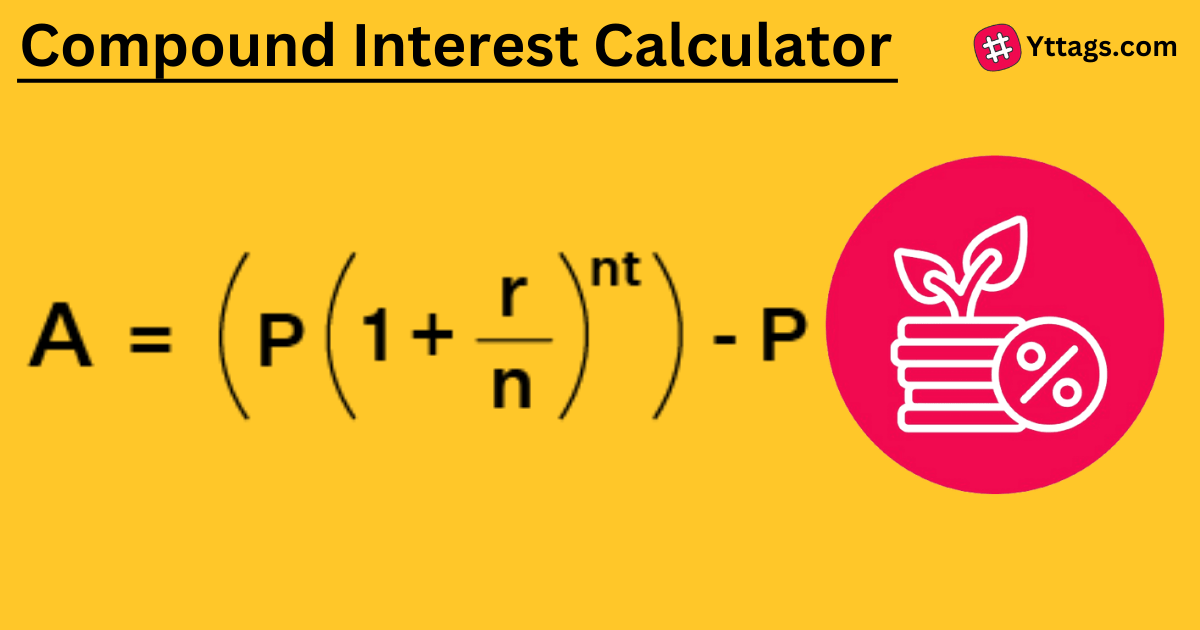

Compound interest calculator finds compound interest earned on an investment or paid on a loan. Use compound interest formula A=P(1 + r/n)^nt to find interest, principal, rate, time and total investment value. Continuous compounding A = Pe^rt.

Online Compound Interest Calculator - Use Our compound interest calculator to calculate compound interest earned daily, weekly, monthly quarterly & annually. Simply, enter the details of the principal amount, interest rate, period, and compounding frequency to know the interest earned.