EMI Calculator

Calculate your EMI online based on your loan period and average interest rate and to know more visit our loan EMI calculator now!

EMI

0

Principal Amount

Interest

Total Payable

If you use this great tool then please comment and/or like this page.

Average Rating: Tool Views: 83

Average Rating: Tool Views: 83

Subscribe for Latest Tools

How to use this EMI Calculator Tool?

How to use Yttags's EMI Calculator?

- Step 1: Select the Tool

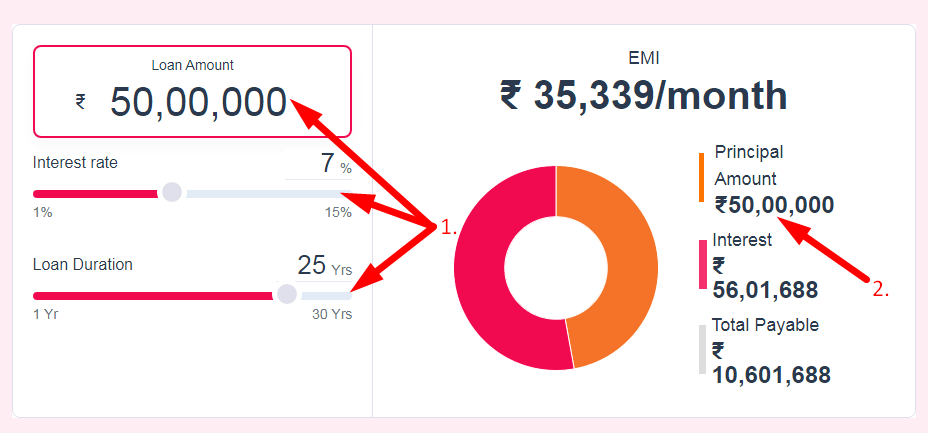

- Step 2: Enter The Following Options And Check Your EMI Calculator Result

EMI Calculator - Calculate Loan EMI in 3 Easy Steps

- ✓ Check your Car Loan, Personal Loan & Home Loan EMI with Flexible Loan Calculator

- ✓ Online EMI Calculator helps you calculate Accurate Loan EMI

- ✓ Yearly & Monthly EMI’s with EASY Graphs

If you want to link to Emi Calculator page, please use the codes provided below!

FAQs for EMI Calculator

What is a EMI Calculator?

An EMI (Equated Monthly Installment) calculator is a financial tool that helps borrowers estimate the fixed monthly repayment amount on a loan, incorporating factors such as loan amount, interest rate, and loan tenure.

What is the rule for calculating EMI?

EMI = [P x R x (1+R)^N]/[(1+R)^N-1]. So to get a comprehensive understanding of these variables, let's discuss them in detail: R represents 'rate of interest'. It is the interest rate that a lending institution charges for a loan.

What is the logic behind EMI calculation?

The EMI flat-rate formula is calculated by adding together the principal loan amount and the interest on the principal and dividing the result by the number of periods multiplied by the number of months.

Which method is used to calculate EMI?

The EMI amount is calculated by adding the total principal of the loan and the total interest on the principal together, then dividing the sum by the number of EMI payments, which is the number of months during the loan term.

What is the maximum EMI rule?

The thumb rule under this mantra is that the total EMI that you pay for all your loans should not exceed 40% of your income.