ELSS Calculator

ELSS Return Calculator - Calculate maturity amont on investment of ELSS scheme with Elss calculator. Plan your goals and invest the lumpsum amount to get approximate returns. Estimate the worth of your ELSS investment over time now.

If you use this great tool then please comment and/or like this page.

Average Rating: Tool Views: 88

Average Rating: Tool Views: 88

Subscribe for Latest Tools

How to use this ELSS Calculator Tool?

How to use Yttags's ELSS Calculator?

- Step 1: Select the Tool

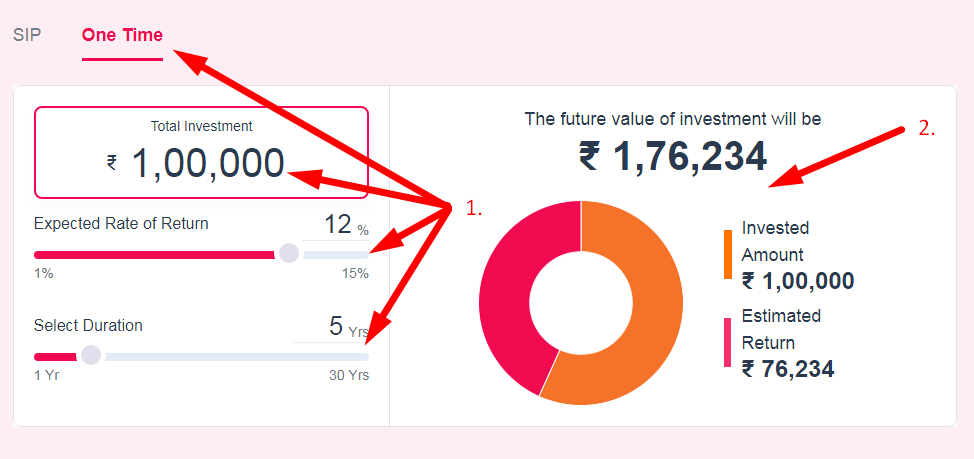

- Step 2: Enter The Following Options And Check Your ELSS Calculator Result

ELSS Calculator - Calculate your interest return for SIP investments or lump sum investment with Our ELSS Calculator. Know about mutual funds, its benefits & how to invest in mutual funds.

If you want to link to Elss Calculator page, please use the codes provided below!

FAQs for ELSS Calculator

What is a ELSS Calculator?

An ELSS (Equity Linked Savings Scheme) calculator is a tool that helps investors estimate potential returns and tax savings on investments in ELSS mutual funds, which offer tax benefits under Section 80C of the Income Tax Act in India.

Is ELSS compounded annually?

Equity Linked Savings Scheme is a type of equity mutual fund with a lock-in period of three years and a tax-saving element. As ELSS returns are linked to equity market movements, it does not provide compound interest like a FD.

How is the lock-in period calculated for ELSS?

The lock-in period for ELSS funds lasts for 3 years from the date of your investment. To find out when it ends, simply add 3 years to the date you invested. If you invest through SIP, consider each installment as a separate investment with its own lock-in period. Once the lock-in period is over, you have some options.

What is a good expense ratio for ELSS?

This includes expense ratio and exit load. Investment companies charge a fee called expense ratio which includes management fees (fees of fund manager) and operational costs. The lower the expense ratio and exit load, the higher the profit. The average expense ratio for a large cap fund is around 0.5-1.5%.

Are ELSS funds active or passive?

SEBI has allowed mutual funds (MFs) with actively-managed tax-saving Equity Linked Saving Scheme (ELSS) to launch the same scheme in passive mode provided they stop inflows into the existing scheme.