CAGR Calculator

Calculate the compound annual growth rate of your sales, costs, market share, performance and other quantifiable data with our easy to use CAGR calculator.

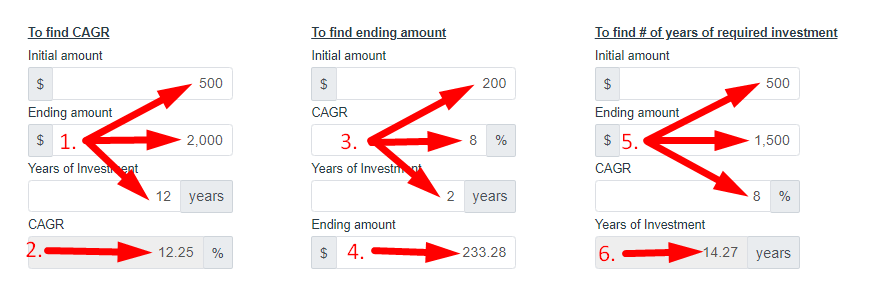

To find CAGR

Initial amount

Ending amount

Years of Investment

CAGR

Initial amount

$

$

years

%

To find ending amount

Initial amount

CAGR

Years of Investment

Ending amount

Initial amount

$

%

years

$

To find # of years of required investment

Initial amount

Ending amount

CAGR

Years of Investment

Initial amount

$

$

%

years

If you use this great tool then please comment and/or like this page.

Average Rating: Tool Views: 107

Average Rating: Tool Views: 107

Subscribe for Latest Tools

How to use this CAGR Calculator Tool?

How to use Yttags's CAGR Calculator?

- Step 1: Select the Tool

- Step 2: Enter The Following Values And Check Your CAGR Calculator Result

CAGR Calculator - Calculate Compound Annual Growth Rate (CAGR) on your investments and discover how much your money have grown over a period of time using this calculator. Learn how to apply CAGR in matters of investment and know about its limitations at Yttags.com.

If you want to link to Cagr Calculator page, please use the codes provided below!

FAQs for CAGR Calculator

What is a CAGR Calculator?

A CAGR (Compound Annual Growth Rate) calculator is a financial tool used to determine the average annual growth rate of an investment or asset over a specified period, taking into account the effects of compounding.

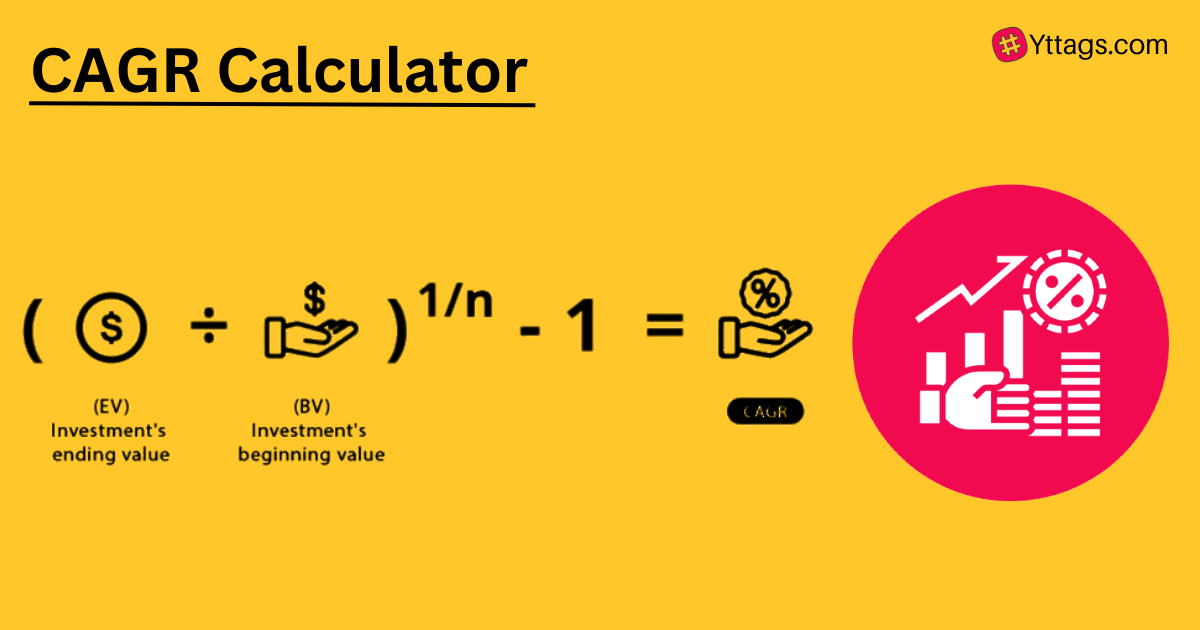

How do you calculate %cagr?

To calculate the Compound Annual Growth Rate (CAGR), you can use the following formula:

CAGR = [(Ending Value / Beginning Value) ^ (1 / n) - 1] * 100%, where "n" is the number of years.

What does 15% CAGR mean?

A 15% CAGR (Compound Annual Growth Rate) means that, on average, an investment or asset has grown by 15% per year over a specified period, considering the effects of compounding.

What is a good CAGR rate?

A good CAGR rate varies depending on the context, but generally, a CAGR of 8-10% or higher is considered strong for long-term investments like stocks, while a CAGR closer to 4-6% might be reasonable for more conservative investments like bonds or real estate.

What is a good CAGR for 10 years?

A good CAGR for a 10-year investment typically falls in the range of 7-10% or higher, but it can vary depending on the asset class and individual investment goals.