SWP Calculator

SWP Calculator - Use Our free online Systematic Withdrawal Plan (SWP) calculator to check how much amount you can withdraw every month and what will be the final value of the investment after a specified tenure.

Invested Amount

Total Withdrawal

Final value

If you use this great tool then please comment and/or like this page.

Average Rating: Tool Views: 162

Average Rating: Tool Views: 162

Subscribe for Latest Tools

How to use this SWP Calculator Tool?

How to use Yttags's SWP Calculator?

- Step 1: Select the Tool

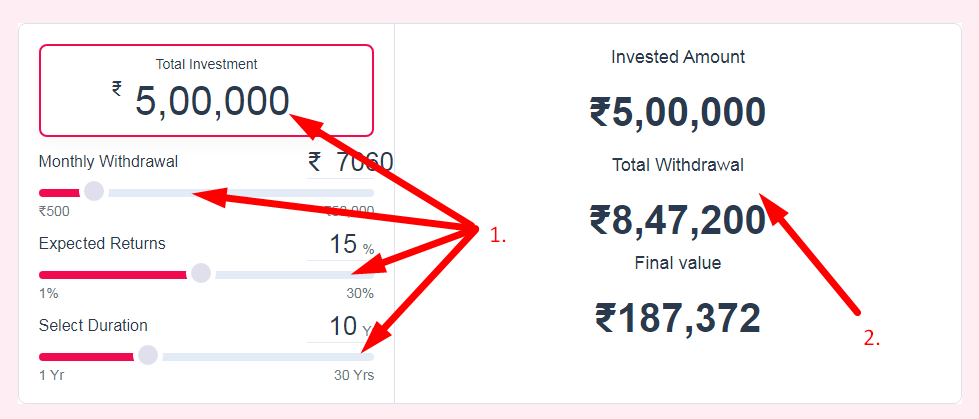

- Step 2: Enter The Following Options And Check Your SWP Calculator Result

SWP Calculator - Systematic Withdrawal Plan calculator takes into consideration of returns from your investment to gives you the total value of your investment at the end of your SWP tenure.

If you want to link to Swp Calculator page, please use the codes provided below!

FAQs for SWP Calculator

What is a SWP Calculator?

An SWP (Systematic Withdrawal Plan) Calculator is a tool that helps investors estimate the periodic payouts they can receive from their mutual fund investments through systematic withdrawals, considering factors like investment amount, withdrawal frequency, and investment performance.

How does SWP calculator work?

The SWP Calculator consists of a formula box, where you enter the total investment amount, withdrawal per month, the expected annual rate of return, and the tenure of the investment. The SWP Calculator shows you the future value of your mutual fund investments.

Does SWP really work?

While the SWP enables you to receive a fixed flow of income regularly, the remaining investment in the schemes are kept to grow over period which will eventually help increasing your corpus size. While an SIP averages out the cost of purchase, SWP averages out the cost of withdrawals.

What are the charges for SWP?

There is no tax deducted at the source for SWP, but depending on the type of scheme, capital gains tax will be charged. If you invested in an equity-oriented scheme and held the investment for less than a year, then the capital gains will be charged at 15%.

What is the 4 rule for SWP?

The 4% rule states that you withdraw no more than 4% of your starting balance each year in retirement. However, the 4% rule doesn't guarantee you won't run out of money, but it does help your portfolio withstand market downturns, by limiting how much is withdrawn.