IRR Calculator

Calculate the IRR (Internal Rate of Return) of an investment and estimate with an unlimited number of cash flows. Enter cash flows, select cash flow frequency and get IRR.

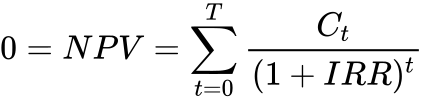

IRR formula

Where:

- C = Cash Flow at time t

- IRR = discount rate/internal rate of return expressed as a decimal

- t = time period

If you use this great tool then please comment and/or like this page.

Average Rating: Tool Views: 1.3k

Average Rating: Tool Views: 1.3k

Subscribe for Latest Tools

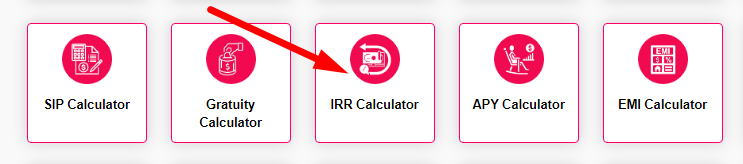

How to use this IRR Calculator Tool?

How to use Yttags's IRR Calculator?

- Step 1: Select the Tool

- Step 2: Enter The Following Options And Click On Calculate Button

- Step 3: Check Your IRR Calculator Result

Calculate the Internal Rate of Return (IRR, discount rate) for any investment based on initial deposit and cash flow per period. ➤ Free IRR calculator online. IRR formula, how to calculate it and how to evaluate investments using it. Internal rate of return calculator for the discount rate / interest rate of an investment.

If you want to link to Irr Calculator page, please use the codes provided below!

FAQs for IRR Calculator

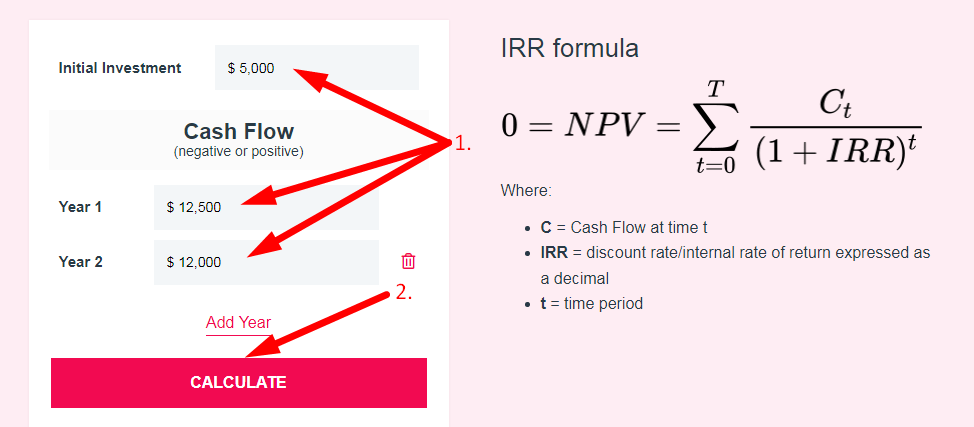

What is a IRR Calculator?

An IRR (Internal Rate of Return) calculator is a financial tool used to calculate the profitability of an investment by determining the discount rate that makes the net present value of the investment's cash flows equal to zero.

What are the rules for calculating IRR?

IRR is calculated using the same concept as net present value (NPV), except it sets the NPV equal to zero. The ultimate goal of IRR is to identify the rate of discount, which makes the present value of the sum of annual nominal cash inflows equal to the initial net cash outlay for the investment.

What are the limitations of IRR method?

It ignores the actual dollar value of comparable investments. It does not compare the holding periods of like investments. It does not account for eliminating negative cash flows. It provides no consideration for the reinvestment of positive cash flows.

How do you know if an IRR is good?

You want a positive IRR—a negative IRR indicates you'd lose money on the investment. Generally, an IRR of 18% or 20% is considered very good in real estate.

What are the benefits of IRR?

The main advantage of the IRR is that it considers the time value of money. This aspect makes evaluating a project's returns more accurate and credible. The major weakness of IRR is that it does not consider the project size, duration, and future cost.